Basic Views on Corporate Governance

Kuraray Co., Ltd. (“Kuraray” or “the Company”) believes that the maintenance of appropriate relationships with various stakeholders and the fulfillment of social responsibilities through establishing a corporate governance system that ensures effective and fair management will contribute to the long-term and sustainable enhancement of corporate value.

The Company has adopted the governance system as “a company with the board of corporate auditors.” Under this framework, the Company has established corporate governance functions centered on its Board of Directors and Board of Corporate Auditors to improve the effectiveness of supervisory and monitoring functions while maintaining management efficiency and handling issues, including management remuneration, selection of new company officers, internal controls, and risk management.

The Company believes that the above establishment of functions contributes to the long-term and sustainable corporate value enhancement.

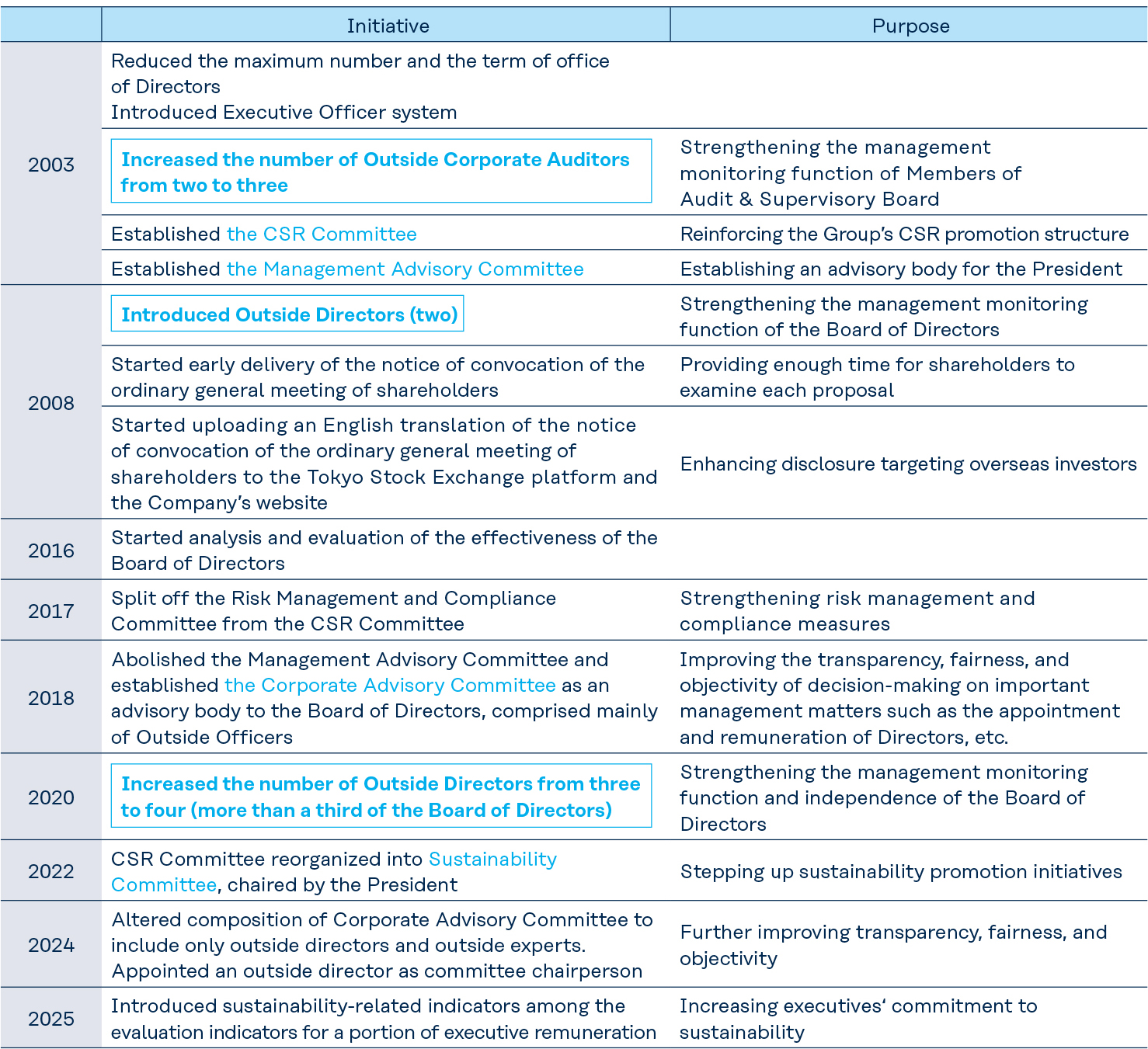

Kuraray’s Steps to Strengthen Corporate Governance

Kuraray’s Steps to Strengthen Corporate Governance

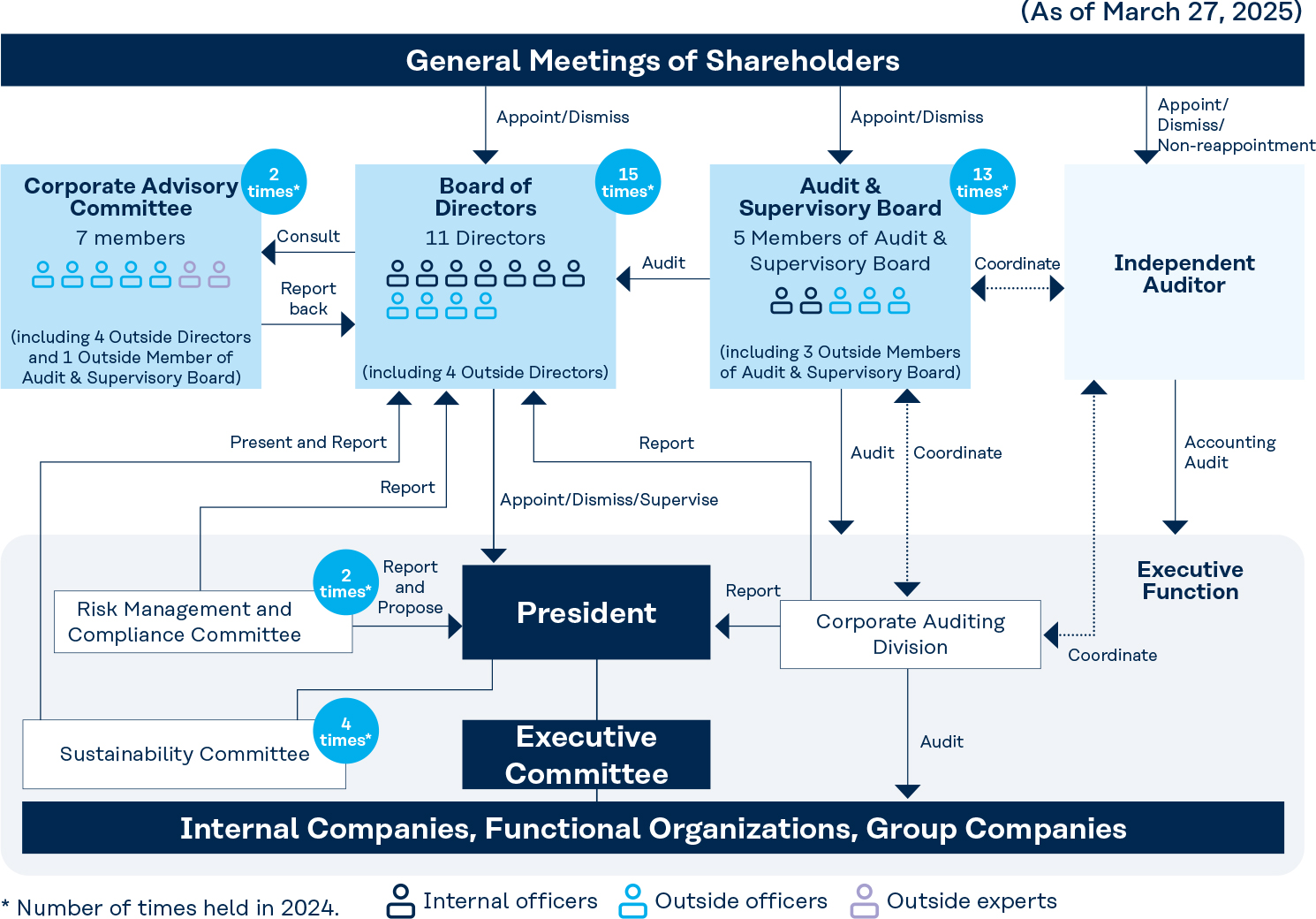

Corporate Governance System

Corporate Governance System

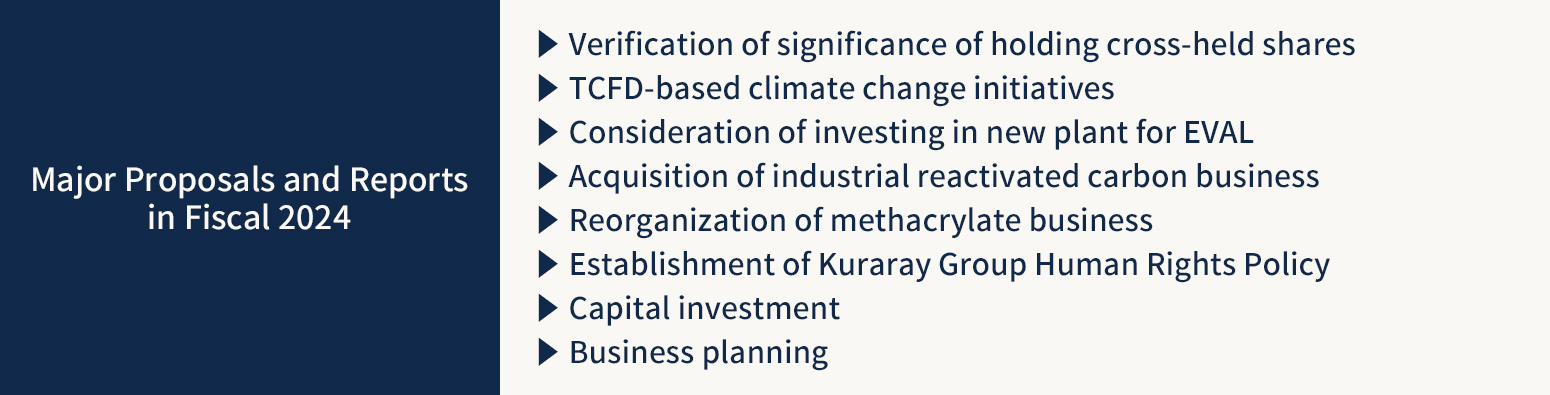

Board of Directors

The Board of Directors, which meets at least once a month, sets bylaws for the Board, deliberates and decides on statutory matters and other key management issues, and supervises business execution. The Board of Directors is chaired by the Chairman and Director. The maximum number of Directors is set at 12, to facilitate agile management decision-making by the Board, and the term of office is set at one year to clarify their responsibilities to shareholders. There are currently 11 incumbent Directors, of whom two are female and one is non-Japanese. Four are Outside Directors, who possess a wealth of experience in and broad insight into the economy, finance, and corporate management, and are responsible for supervising management from an independent, third-party standpoint.

Audit & Supervisory Board and Internal Audits

The Audit & Supervisory Board consists of five Members, including three independent Outside Members of Audit & Supervisory Board. Four are male and one is female. The Audit & Supervisory Board convenes monthly, in principle.

The Members of Audit & Supervisory Board meet regularly with the Independent Auditor and receive reports on audit planning, implementation status, and audit content. They also receive reports on the results of internal audits from the Corporate Auditing Division, the in-house audit department. In addition, the Members of Audit & Supervisory Board serve as corporate auditors at major Group companies and conduct Group company audits as appropriate. They also attend the periodic Group Auditor Liaison Meetings consisting of the Group company auditors to gain information on the respective companies.

There are also staff to assist the Members of Audit & Supervisory Board in carrying out their duties.

Corporate Advisory Committee

The Company has established a Corporate Advisory Committee composed of Outside Officers and outside experts to serve as an advisory body to the Board of Directors. The committee works to improve the transparency, fairness, and objectivity of decision-making on important management matters such as the appointment and remuneration of Directors and further enhance corporate governance. Corporate Advisory Committee meetings are held twice a year in principle.

The committee consists of seven members: four Outside Directors (Ms. Keiko Murata, Mr. Satoshi Tanaka, Ms. Naoko Mikami, and Mr. Toshifumi Mikayama), one Outside Member of Audit & Supervisory Board (Ms. Tomomi Yatsu), and two outside experts (Mr. Go Egami [listed under the name Mr. Haruki Kohata] and Mr. Jun Hamano). The committee is chaired by an Outside Director.

Risk Management and Compliance Committee

The committee, under the direct control of the President, is tasked with ensuring the appropriate management of risks that could have a significant impact on business management, thorough compliance with laws and regulations and corporate ethics, and fair business practices. The committee identifies material risks and proposes them to the President in its regular monitoring of risks for Group companies. The President then specifies those that require countermeasures as management risks and appoints a supervising officer for each risk to implement risk avoidance and mitigation measures. This committee also reports on a range of activities to the Board of Directors and incorporates their direction in future risk response measures.

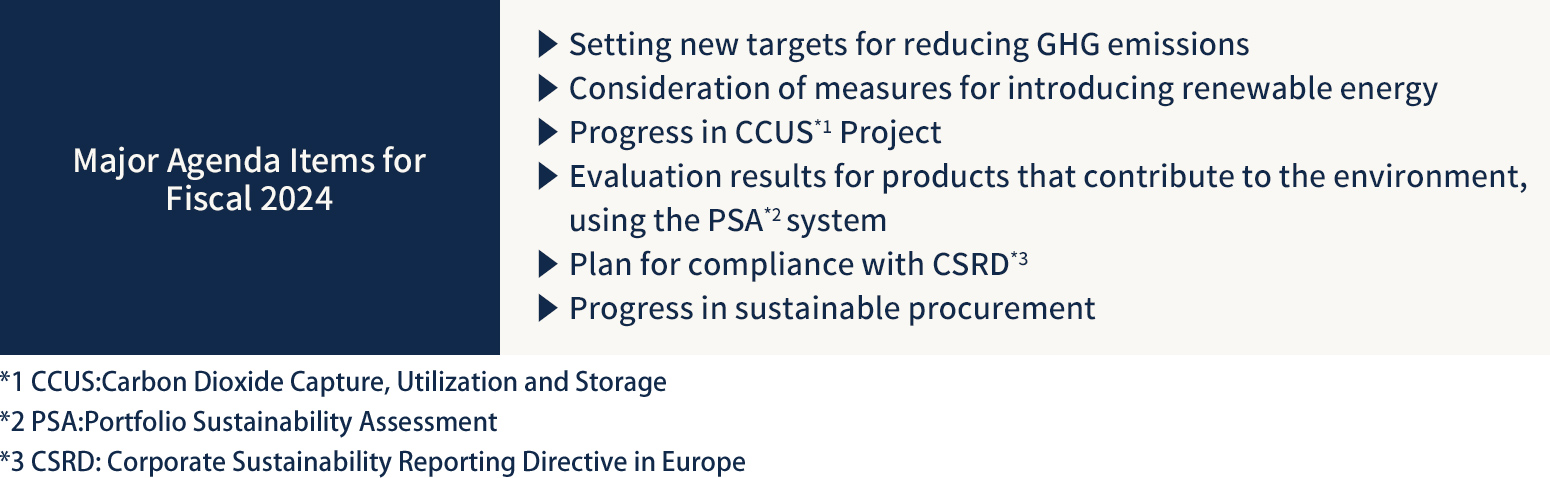

Sustainability Committee

In January 2022, the Kuraray Group established a Sustainability Committee to replace the CSR Committee. Chaired by the President, the committee makes swift decisions regarding sustainability issues at the management level, expedites the planning and implementation of response measures, and reinforces sustainability initiatives in the Group. The Sustainability Committee also reports on a range of activities to the Board of Directors and reflects Board directives in sustainability initiatives.

Policies for the Appointment of the Candidates for Directors and Corporate Auditors and the Independence Standards for Outside Officers

Policies for the Appointment of the Candidates for Directors and Corporate Auditors

The Company appoints individuals who have the experience, knowledge, and capabilities required for Directors of the Company at Board of Directors meetings with the attendance of Outside Officers, and elects them as Directors with a resolution of the General Meeting of Shareholders. However, candidates for Outside Directors will satisfy the criteria of independence provided separately.

The Company appoints individuals who have the experience, knowledge, and capabilities required for Corporate Auditors of the Company at Board of Directors meetings with the attendance of Outside Officers, and elects them as Corporate Auditors with a resolution of the General Meeting of Shareholders after obtaining the consent of the Board of Corporate Auditors. However, candidates for Outside Corporate Auditors will satisfy the criteria of independence provided separately.

The election and dismissal of Directors and the appointment and removal of Representative Directors and Directors with special titles are determined by the Board of Directors after deliberation by the Corporate Advisory Committee.

Independence Standards for Outside Officers

- (1) The Company judges that its Outside Officers and the candidates for the Outside Officers are fully independent of the Company if they do not fall under any of the following items:

-

- A business executive of the Group

- A counterparty that has transactions principally with the Group, or its business executive thereof

- A major business partner of the Group, or its business executive thereof

- A major lender of the Group, or its business executive thereof

- A counterparty that receives a large amount of donations from the Group, or its business executive thereof

- A major shareholder of the Company (who possesses 10% or more of the total voting rights either directly or indirectly), or its business executive thereof

- A business executive of the party whose major investor (who possesses 10% or more of the total voting rights either directly or indirectly) is the Group

- A consultant, certified public accountant, or other accounting professional, attorney, or other legal professional who receives a large amount of monetary or other assets from the Group other than the executive remuneration (in case of a legal entity, association, or other organization, a person belonging thereto)

- A person who belongs to an accounting firm that conducts the statutory audit of the Company

- A person who has fallen under the above criterion (i) in the past 10 years

- A person who has fallen under any of the above criteria (ii) through (ix) in the past three years

- A person whose position constitutes him/her as having an Outside Officer’s interlocking relationship with the Group

- A relative of the persons listed in the above criteria (i) through (xi)

- (2) Even in cases where a person falls under any of the above items, if the person is deemed to be appropriate for the post of an independent Outside Officer in light of his/her personality, knowledge, and other qualities, the Company may appoint him/her as independent Outside Officer on the condition that the reasons why the person is deemed appropriate for the post are explained to the public.

Areas Particularly Expected of Directors and Members of Audit & Supervisory Board

The Company has a broad array of businesses globally, including resins, chemicals, activated carbon, and fibers & textiles. In light of the characteristics of each business, we believe that in order to ensure appropriate and agile decision-making and supervision over execution, the Board of Directors and Audit & Supervisory Board must demonstrate expertise and business experience in a variety of fields, as well as diversity in such terms as gender and nationality.

To ensure this, the Company has identified nine areas of knowledge, experience and expertise that are particularly expected of directors and Audit & Supervisory Board members: “Corporate Management,” “Global,” “Sales and Marketing,” “Production and Equipment Technology,” “R&D,” “Legal Affairs and Risk Management,” “Finance and Accounting,” “Environment and Society,” and “Human Resources and Labor Management.”

Skills Matrix*

Support System for Outside Officers

Information is shared with Outside Officers by distributing and explaining in advance the proposals to be deliberated at the regular and extraordinary meetings of the Board of Directors. Staff from the Secretariat Group of the General Affairs Department assist in sharing this information with Outside Directors. Staff are appointed to assist Corporate Auditors including Outside Corporate Auditors. Staff collect and provide

information necessary for their auditing activities and offer other forms of support.

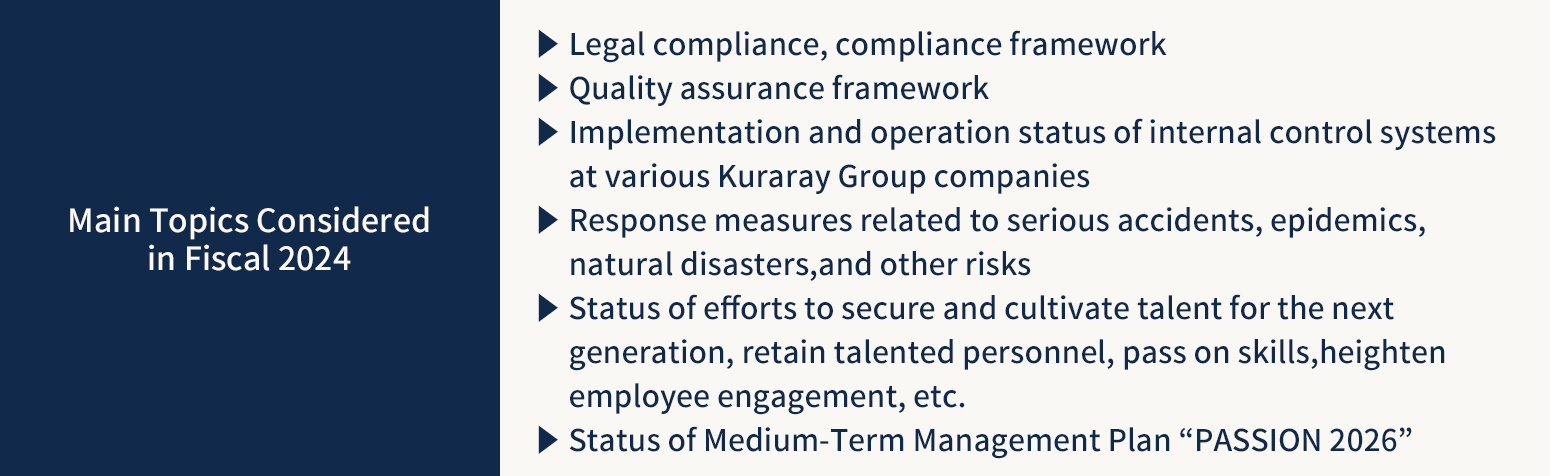

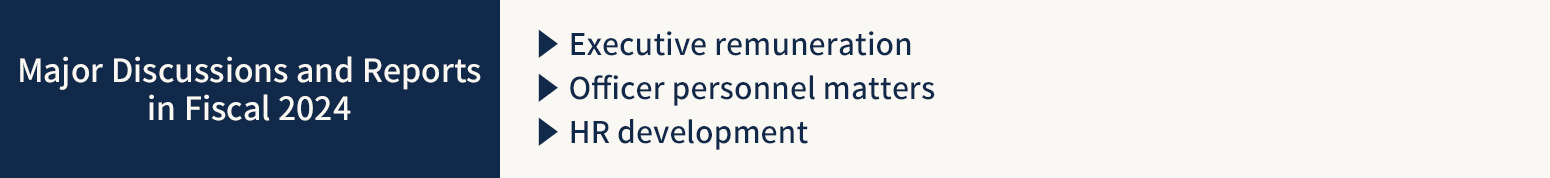

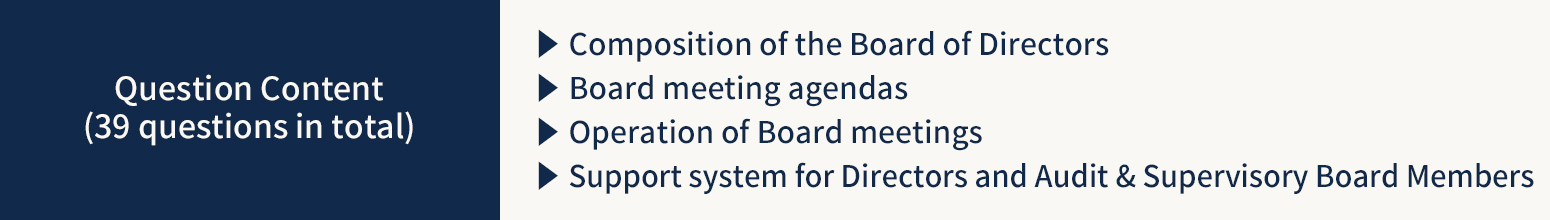

Evaluation of the Effectiveness of the Board of Directors

Every fiscal year, the Company evaluates and verifies the effectiveness of the Board of Directors to make improvements as needed.

In fiscal 2024, the Company administered a signed questionnaire for evaluating the effectiveness of the Board of Directors to all Directors and Members of Audit & Supervisory Board. The secretariat of the Board of Directors aggregated the responses and opinions and analyzed and evaluated the effectiveness of the Board of Directors based on the data.

Summary of Evaluation Results

Questionnaire responses were positive overall, including the fact that Board discussions are active and that the strengthening of each director’s expertise has improved effectiveness, thereby confirming that the Company’s Board of Directors is generally functioning properly, and that the effectiveness of the Board of Directors is being ensured.

The previous effectiveness evaluation identified issues including the need to deepen discussions around the construction of a more sophisticated business portfolio, medium- to long-term management strategies, and management that is attuned to the cost of capital. In fiscal 2024, the Company accordingly instigated a review of the medium term management plan by management, including members of the Board of Directors, also steadily implementing measures to invigorate and enhance discussions at Board of Directors meetings.

This latest effectiveness evaluation identified the following issues: expanding and deepening Corporate Advisory Committee discussions, and strengthening the monitoring function within the internal control system for the entire Group.

Key Comments

- Outside directors’ proactive comments have delivered many insights, leading to lively discussions.

- Efforts to implement management that is conscious of the cost of capital and stock price are gathering momentum, as are efforts to reshape the business portfolio.

- The Corporate Advisory Committee should hold more in-depth discussions on important matters such as personnel and remuneration.

- As the organization expands and diversifies globally, efforts are being made to further strengthen internal audits. Comprehensive and exhaustive reports and discussions are required regarding the establishment of an internal control system for the entire Group.

Initiatives for the Future

The Kuraray Group continues to seek to improve the effectiveness of the Board of Directors based on past evaluations of its effectiveness and issues to be considered. In fiscal 2025, the Company will continue implementing the necessary measures to address issues such as reviewing the composition and agenda of the Corporate Advisory Committee and establishing a forum for discussing the internal control system for the entire Group, and will continue making efforts to improve the effectiveness of the Board of Directors.

Officers’ Remuneration System

Basic Policy

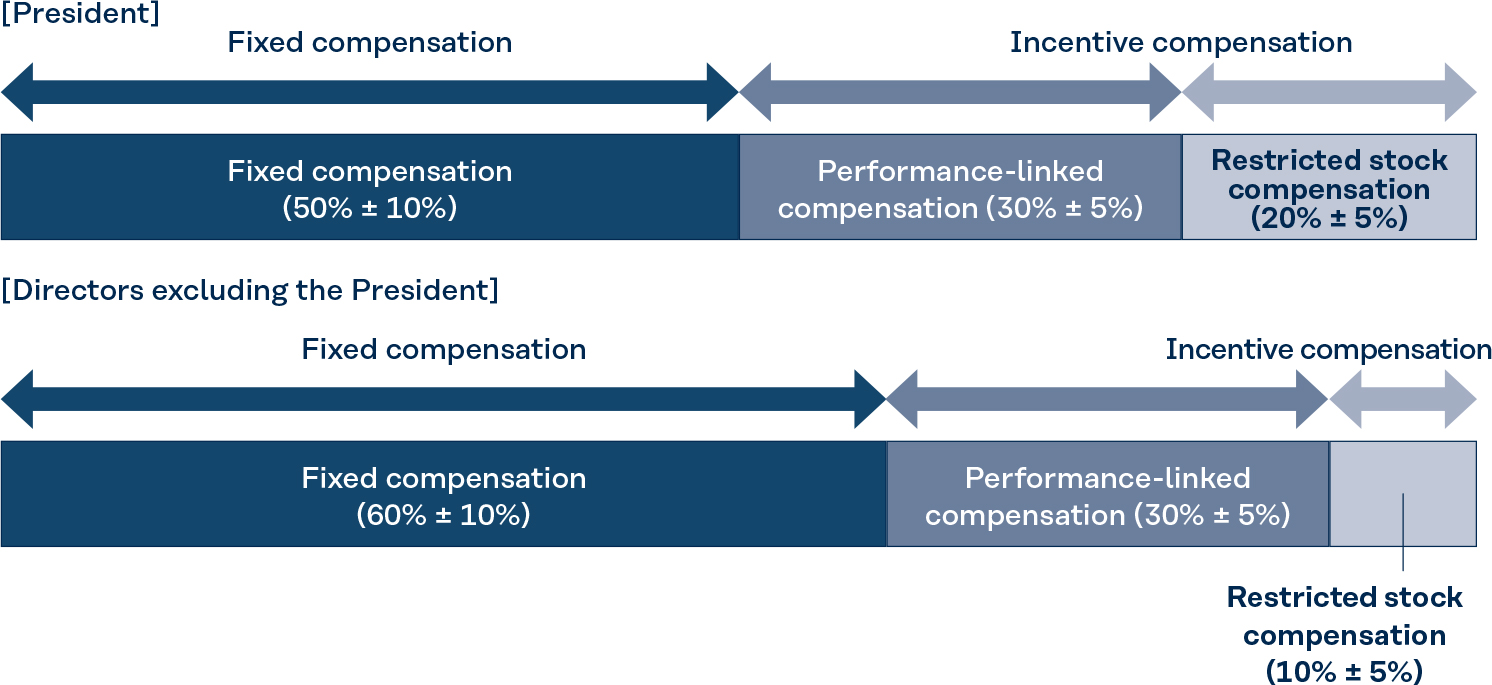

The Company’s basic policy for the remuneration of its officers is to have a competitive level and system of remuneration that can secure and retain competent Directors fit for their positions and responsibilities to achieve long-term and sustainable improvements in corporate performance and corporate value. The remuneration system for Directors comprises three parts: (1) fixed remuneration as basic remuneration per job responsibilities, (2) performance-linked remuneration as an incentive to achieve yearly business results, and (3) stock-based remuneration designed to enhance corporate value over the medium to long term and sharing of value with shareholders through appropriate corporate management, provided that remuneration for Outside Directors will solely comprise fixed remuneration without performance-linked or stock-based remuneration, as their role is to supervise management from an independent standpoint.

The specific level and system of remuneration will be verified and deliberated by the Corporate Advisory Committee, made up of outside officers and outside experts, on whether the level and system of remuneration are appropriate, based on the results of a survey by a specialized external research institution on executive remuneration covering companies such as those listed on the First Section of the Tokyo Stock Exchange, and the salary of the managers of the highest level in the Company. The Board of Directors receives reports on the results from the Committee and gives it due consideration to determine the level and system of remuneration.

Details of the amount of remuneration are provided in the officers’ remuneration section of the securities report (Japanese only).

Composition of compensation, etc.

(Assuming the target set at the beginning of the year is achieved)

Method for determining the amount of compensation (incentives), etc.

| Performance- Linked Remuneration System |

The Company abolished the bonus scheme for Directors and introduced a performance-linked remuneration system in July 2006, thereby strengthening the incentives of Directors to increase the Company’s corporate value. In addition, to respond to the increase in the amount of performance-linked remuneration in conjunction with improved business performance, it was resolved to increase the maximum amount of annual monetary remuneration to Directors from ¥450 million to ¥800 million (including ¥100 million annually for Outside Directors) at the Company’s 131st Ordinary General Meeting of Shareholders, held on June 22, 2012. Performance-linked remuneration is not paid to Outside Directors. (Calculation Method) As a short-term performance incentive, the performance-linked remuneration for the President will be the amount that is obtained by multiplying the amount of actual net income attributable to owners of the parent for the current fiscal year (before deducting performance-linked remuneration [bonus]) by 0.75/1000. The performance-linked remuneration for Directors will be determined by multiplying the said amount by a predetermined index corresponding to each Director’s position. The amounts of performance-linked remuneration paid to Directors in charge of business units will be determined so that they partially reflect the performance of the relevant business units. |

|---|---|

| Restricted Stock Compensation Plan |

At the 140th Ordinary General Meeting of Shareholders held on March 25, 2021, the Company resolved to abolish the existing stock option plan*1 and introduce a restricted stock compensation plan, with the aim of incentivizing Internal Directors and Executive Officers to improve the Company’s corporate value in a sustainable manner as well as raise the degree to which they share value with shareholders. In view of changes in the stock price since the introduction of this plan, and in light of a potential increase in the total amount of monetary compensation to be paid to eligible directors for granting restricted stock following inclusion in the plan of evaluation based on sustainability-related indicators, at the 144th Ordinary General Meeting of Shareholders held on March 27, 2025, the Company furthermore resolved that restricted stock compensation for Directors under the plan be capped at an annual amount of ¥180 million. The number of shares to be granted under the plan will not exceed 60,000 shares each year. Restricted stock compensation is not paid to Outside Directors. Monetary compensation linked to stock price (phantom stock) has been introduced in lieu of restricted stock compensation for Directors who are non-residents of Japan. (Calculation Method) The President will be allotted a number of shares in consideration of the responsibilities of the position and the level of compensation at other companies while Directors other than the President will be allotted a designated number of shares by position, and both allotments will reflect an evaluation based on sustainability-related indicators*2 (applied within a range of ±20%). *1 The exercise of previously granted stock options held by Directors and Executive Officers on retirement will continue until such time as all Directors and Executive Officers currently holding stock options have retired. *2 We have adopted five sustainability-related indicators: environmental contribution (achievement of GHG emissions reduction targets), occupational health and safety (achievement of targets for occupational accident frequency rate and number of safety-related incidents), diversity (improvement in the ratio of female managers), and engagement (improvement in engagement survey scores and response rates). |

Cross-Shareholdings

The Company has set forth the policy on cross-shareholdings and standards for exercising voting rights pertaining to cross-held shares as follows.

- 1) Coming from the viewpoint of stable and long-term business operation, the Company may hold the shares of its business partners, etc., if maintaining and strengthening the relationships with such business partners are deemed to contribute to corporate value enhancement.

- 2) Regarding the shares held pursuant to the preceding paragraph (hereinafter, “cross-held shares”), the Company regularly examines economic rationality and significance of holding individual stock at the Board of Directors meetings in consideration of benefits and risks associated with such holding, capital cost and other factors. The Company will sell shares of stocks, as necessary, whose holding was deemed not to be appropriate based on the examination to reduce such stocks.

- 3) Concerning the voting rights pertaining to the cross-held shares, the Company appropriately exercises such voting rights in light of the objectives of shareholdings set forth in the preceding two paragraphs, taking into consideration the business conditions of the companies and potential impact to the business operation of the Company or a subsidiary of the Company (hereinafter “the Group”). Particularly, the Company carefully exercises such voting rights in a case where performance of the companies has been sluggish for a long period of time or a serious scandal has occurred or in a case where a proposal that would impair shareholders’ value was made.

Examination of the Propriety of Holding Cross-Held Shares

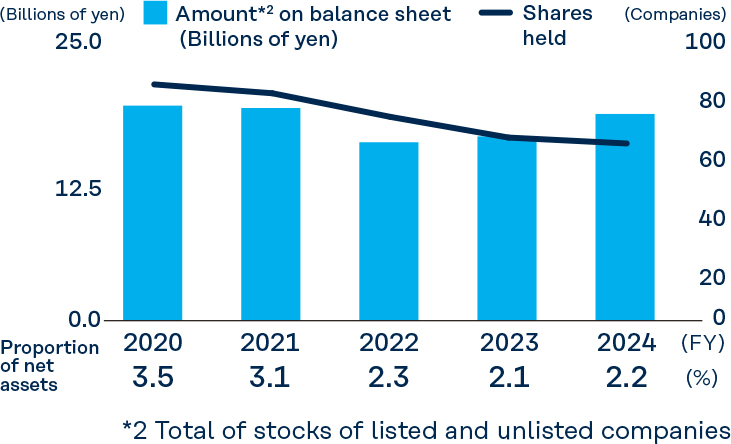

The Board of Directors regularly verifies the economic rationality and significance of holding shares (cross-shareholdings), and seeks to sell shares, as necessary, whose holding is deemed not to be appropriate, to reduce such stocks. In fiscal 2024, out of its cross-shareholdings in listed companies, the Company sold a portion of stocks held in five companies. This brought the ratio of cross-shareholdings to net assets to 2.2% as of the end of fiscal 2024.

Status of Cross-Shareholdings