Global Warming Prevention

Response to TCFD Recommendations

In November 2020, Kuraray Group endorsed the recommendations of the Task Force on Climate-Related Financial Disclosure (TCFD)* in recognition of the importance of the climate change control as one of our high-profile issues. The Sustainability Medium-Term Plan, which started from 2022, includes measures to mitigate climate change such as reducing greenhouse gas (GHG) emissions, pursuing energy savings, expanding the products that contribute to improve the natural environment and responding to the Circular Economy. In addition to implement these measures gradually, we will enhance the disclosures of strategy, based on governance and scenario-based analysis, risk-management, indicators and targets which are recommended by TCFD.

*TCFD stands for “Task Force on Climate-related Financial Disclosures” which has been established under Financial Stability Board (FSB) to review how to correspond to climate change disclosures and requirements from the financial sector.

Governance

In Kuraray Group, Sustainability Committee, chaired by the president, promotes sustainability activities. Under the umbrella of this committee, we will establish several project teams to implement the global measures outlined in the Sustainability Medium-Term Plan and promote each project. In addition to confirm the progress of the projects relates to climate change control, TCFD Promotion Project Team, which has been established under the umbrella of Sustainability Committee, will enhance the disclosure based on TCFD Guidance.

Topics discussed at Sustainability Committee are going to be reported to the Board of Directors and the feedback from them would be reflected in the future sustainability activities.

Strategy

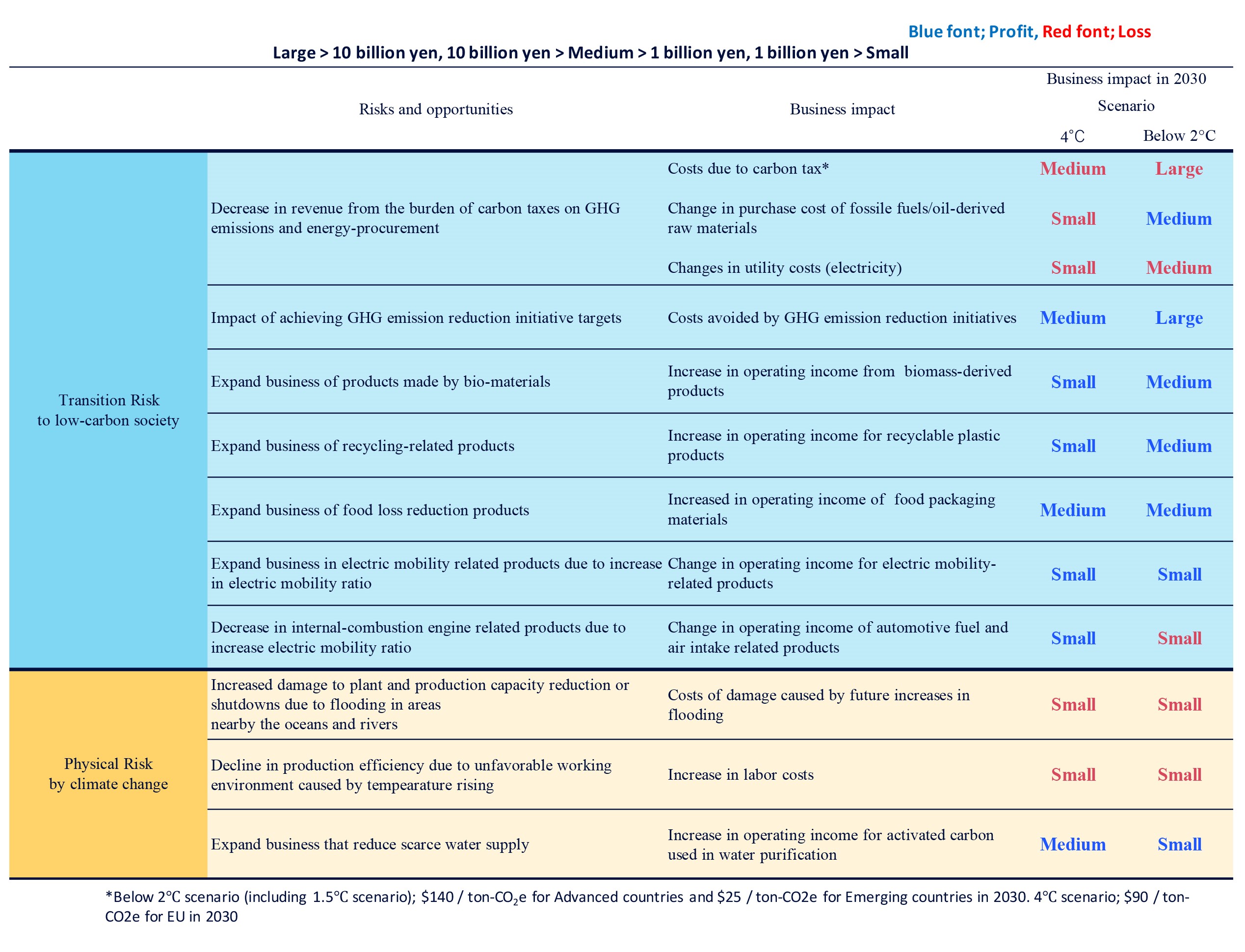

In 2021, Kuraray Group selected the risks and opportunities for events occurring in the transition to a low-carbon society and for physical events caused by climate change as shown in Table 1 below.

Table1: Risks and Opportunities by Climate Change in Kuraray Group

In 2022, we have started scenario analysis based on the below 2-degree scenario (including a 1.5-degree scenario) in which the transition to a low-carbon society is progressing and the 4-degree scenario in which climate change is advancing, and in 2023 we completed a business impact assessment of the major risks and opportunities for the entire Kuraray Group. For this, we drew on insights from reports such as the World Energy Outlook published by the International Energy Agency (IEA). The results are shown in Table2.

Table2: Business Impact of the Kuraray Group’s Major Risks and Opportunities in Climate Change Scenarios

The impact of * carbon prices on GHG emissions and energy procurement in the 2°C or below scenario was significant. After the implementation of measures to reduce GHG emissions in 2030, Kuraray Group was expected to bear a burden by carbon tax of approximately 32 billion Japanese yen, indicating the possibility of increased operating costs. As a countermeasure, we will steadily advance our GHG emission reduction program toward the goal of zero-carbon emissions by 2050, while at the same time reflecting the market value created by highly environmental contribution products in product and service prices.

*Calculated based on World Energy Outlook 2022 at $140 /ton-CO2e for developed countries, $25 /ton-CO2e for emerging countries [2030, 1.5°C scenario]

In the future, we will respond to the major impacts derived from scenario analysis, while at the same time reviewing and reflecting the calculation detail in a timely manner in response to changes in the environment.

Risk Management

Kuraray Group conducts risk management for both “Mitigation” and “Adaptation” to the risks listed in Table 2.

In order to "mitigate" the risk of transition to a low-carbon society, we are reducing GHG emissions and expanding sales of products that contribute to the natural environment. Progress is confirmed by the Sustainability Committee (chaired by the president).

Meanwhile, each organization conducts annual risk self-assessments of "adaptation" measures against climate change to strengthen disaster countermeasures and business continuity. The results of these assessments are discussed by the Risk Management and Compliance Committee (chaired by the director in charge of the Corporate Sustainability Division), and if countermeasures are necessary, the president identifies them as management risks and appoints a person in charge to proceed with countermeasures.

Metrics and Targets

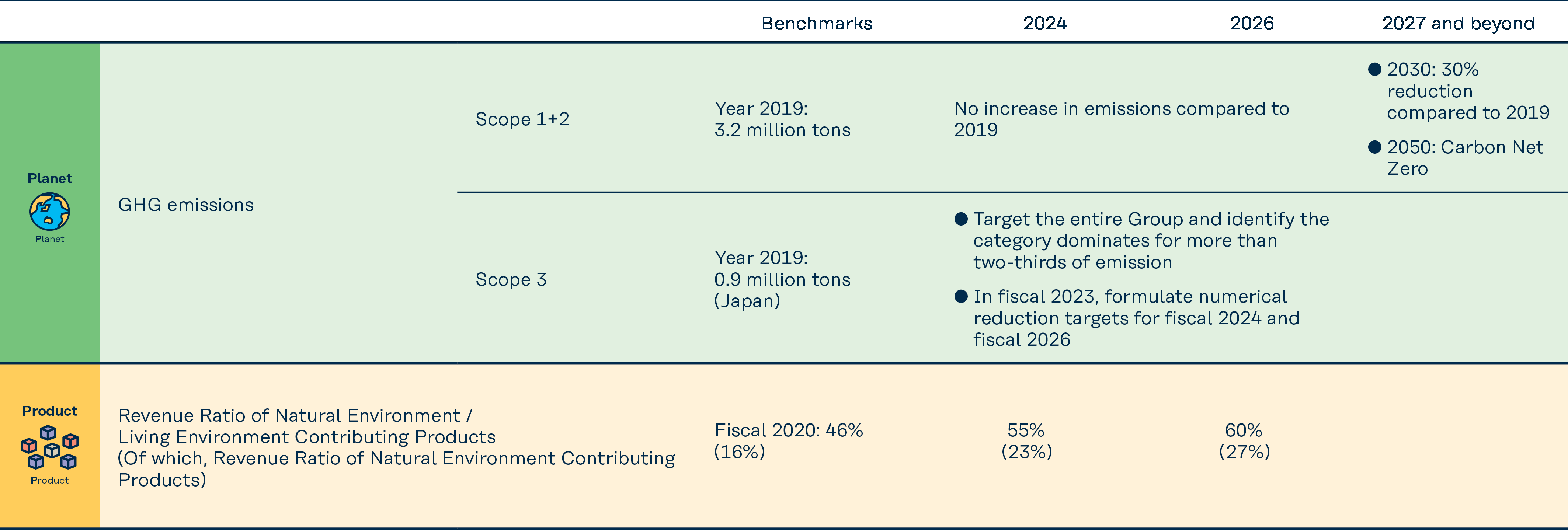

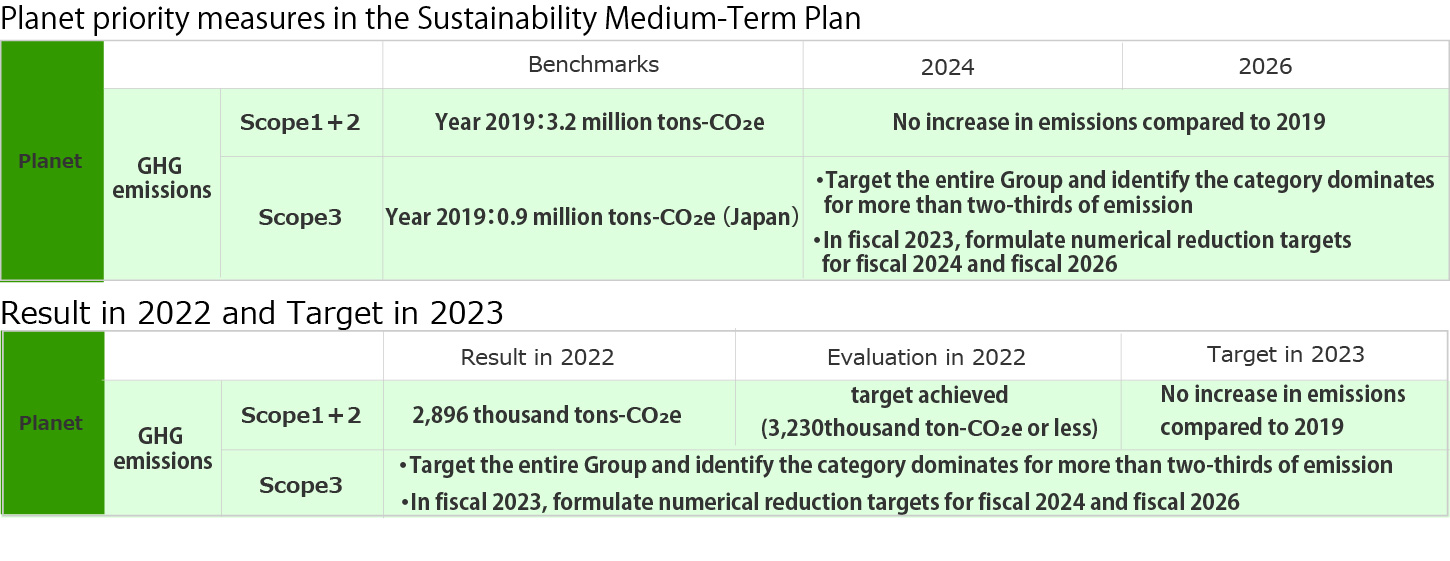

As our long-term goal for mitigating climate change, we will target to reduce our own GHG emissions (Scope1 and 2) by 30% in 2030 compared with in 2019 and to achieve carbon net zero in 2050. In the Sustainability Medium-Term Plan, we have set the following targets for reducing GHG emissions related to climate change and for the Revenue ratio increase of natural environment contributing products.

Table3: Measures and Targets Related to Climate Change in the Sustainability Medium-Term Plan

Internal Carbon Pricing(ICP)

The Kuraray Group uses ICP to incentivize energy saving, identify revenue opportunities and risks, and inform investment decision making, aiming to realize a low-carbon society.

The Kuraray Group's ICP

| Internal carbon price | ¥10,000/t-CO2 (calculated using internal exchange rates overseas) |

|---|---|

| Starting Date | January, 2022 |

| Scope | Capital investment entailing a change in CO2 emissions |

| Method of application | The costs of changes in CO2 emissions will be calculated using the internal carbon price and used as a criterion for investment decisions |